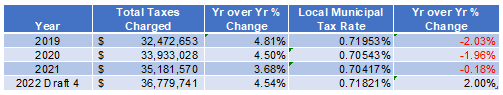

On Monday December 20, 2021, at 5:00pm members of Council formally adopted the 2022 Municipal Operating and Capital Budgets. This final budget includes a 2.00% tax rate increase over 2021.The table below details the change in the total taxes collected over the past 4 years:

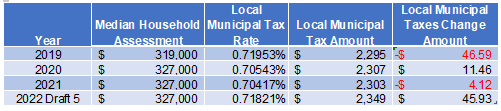

This equates to the following impact on the median assessed home, note that for the 2022 tax year MPAC will once again hold current assessed values:

Additionally, a $30,000 increase in the Special Capital Levy is included, which would result in a median assessed home paying an additional $1.93 per year.

The Town of Collingwood has started drafting its 2022 Operating & Capital Budget. As community engagement and consultation is a critical component of this process we want to hear from you!

Through the draft 2022 Budget, the Town strives to balance the needs of current residents and the challenges of our community’s unprecedented growth and mounting investment needs, with finding opportunities for service efficiency, business attraction, and enhancements to our waterfront and public spaces.

Please take a few minutes to fill out the survey below to tell us what is important to you in how we invest your tax dollars. - Survey now closed

What is a budget?

It is the most important document that any government adopts. It is a plan that sets out anticipated spending for the year and where the money will come from. It determines the services the municipality will provide and defines any improvements or expenses related to buildings or resources that will be made that year. A budget is the blueprint that outlines how municipal funds are collected and allocated. The overall budget can be separated into two main components – the Operating Budget and the Capital Budget.

What is an Operating Budget?

The operating budget is the plan for the day-to-day operations of the Town including salaries, legal and insurance costs, and winter control. These expenses are required annually to run the municipality. Every Town program and service is funded through the operating budget, which is designed to ensure dependable delivery of a broad array of programs and services that residents rely on every day. Your municipal government is responsible for providing fire and police services, roads, clean water, parks, arenas, library services, and much more. Many of these services are available 24 hours a day, seven days a week. These services and programs are largely funded by tax dollars and user fees which include charges for recreation programs, water, and wastewater services.

What is a Capital Budget?

The capital budget is the annual plan for the purchase and financing of the Town’s capital assets. Capital assets are projects and expenses where the benefits can be seen over the course of many years, such as roads, bridges, land, buildings, machinery, and equipment. Some examples of capital projects include intersection improvements at Third Street & High Street, the Stewart Road Reservoir, The Black Ash Pumping Station upgrade, and the Sunset Point Park Playground project. The bulk of the capital spending goes to maintaining and fixing existing infrastructure, and is funded through dedicated accounts (similar to savings accounts) that have been built up through taxation and grants.

Building new infrastructure that is needed for keeping up with the growth of the community is funded through charges on the new developments being built.

Balancing the Budget

Each year municipalities are faced with the challenge of balancing the budget, as required by provincial legislation. A municipality can take on debt to pay for large capital acquisitions, however it must ensure that there is enough money to fund day-to-day operations. In order to balance the budget, a careful analysis must be done regarding the level of services required to meet the expectations of the community and the realistic taxation and user fee levels.